We’ve broken down the major SAP® SuccessFactors® H1 2022 updates into bite-sized pieces to help you easily digest the latest changes. In this post, we’ll look at what’s new in Global Benefits.

Employee Central | Employee Central Payroll | Performance & Goals | Platform | Succession & Career Development | Integrations | Compensation & Variable Pay | Recruiting Management & Marketing | Onboarding | Learning Management System (LMS) | Reporting | Time Tracking

SAP continues to innovate and improve the Global Benefits platform experience and H1 further demonstrates that commitment and investment. The following details do not begin to highlight all of the major features released in H1, however, these are some of the most impactful to Rizing’s customers.

Replacement of Auto Enrollment Job with Updated Features: Ref. #: KM-14239

The current “Auto Enrollment Job is being deleted on May 19, 2023” is being broken apart due to previous consumption rules and limitations. This is being replaced by two pieces of functionality:

- Create or Update Benefit Enrollments for Benefit Master Data Changes

- Create or Update Benefit Enrollments for Benefit Master Data Changes Job

Customers will need to set up the two replacement pieces to replace the current job. This is required if a customer currently has Auto Enrollment turned on.

How to turn it on: Universal

EXAMPLE:

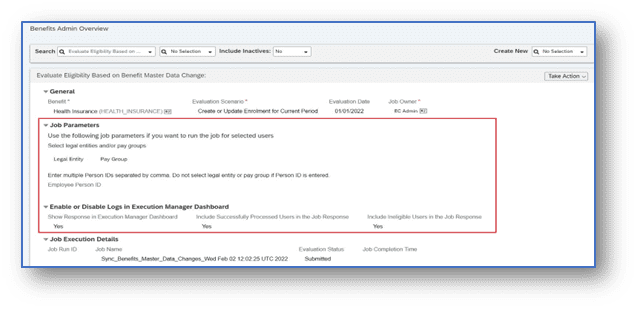

New Filters for Create or Update Benefit Enrollments: Ref. #: BEN-9983

Being introduced is the expanded capability to create eligibility rules based on more than the Legal Entity (this is big!).

Included in this release is:

- Filter selection for Pay Group

- Filter for Employee Person ID

- Job Parameters and Enablement for Job Logs on Execution Manager Dashboard

Before this change there has been only the ability to set the Create/Update Eligibility at the Legal Entity level of Master Data and then there you would have to run the job for all users, not being able to provision in specificity.

How to turn it on: Admin Opt-in

EXAMPLE:

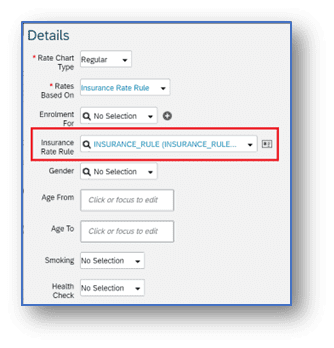

Insurance Rate Charts Based on Expanded Standard Fields & Custom Fields: Ref. #: BEN-9208

Insurance rate cards are getting a big upgrade this release. In the past, customers that had complex rate rules were limited to maintain their rates within the application and had to resort to work arounds to support their needs. This functionality has been greatly expanded so that now, rates can be defined based on employee experience or employee salary. This was accomplished by adding custom field capability and a list of standard fields:

- Legal Entity

- Country / Region

- Job Classification

- Employment Type

- Employee Class

- Contract Type

- Regular or Temporary

- Pay Grade

- Business Unit

- Cost Center

To help along this configuration is a new field called “Rates Based On”. This field allows a rule to be defined and tied directly to the benefit and the rate table within the platform itself. Earlier, this was handled either by using multiple plans to accommodate the complexity, or by handling the rate outside of the application.

How to turn it on: Admin Opt-in

EXAMPLE:

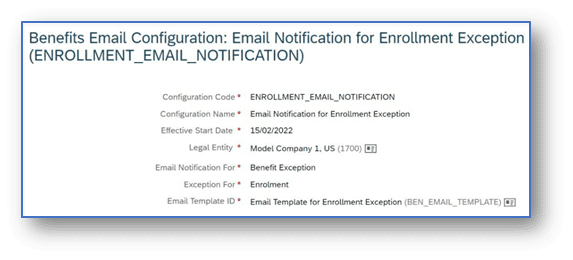

Email Notifications Available for Benefit Exceptions: Ref. #: BEN-5438

Employees are now able to be notified that there is an action needed on their benefits when outside of an Open Enrollment window (either by Intelligent Services or by Manually transacted). This has been a gap in the solution for some time and our Customers are excited to see this filled. Details included within these notifications can be defined within the Document Generation Template.

How to turn it on: Admin Opt-in

EXAMPLE:

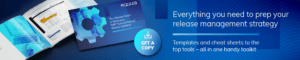

Employer Contribution for Workplace Pension Receives a Payroll Enhancements: Ref. #: BEN-4667

For the Workplace pension plan, the Employer Contribution Amount, Employer Contribution Percentage, and Additional Voluntary Contribution amount fields are now replicated from Employee Central to Employee Central Payroll (InfoType 0014).

How to turn it on: Admin Opt-in

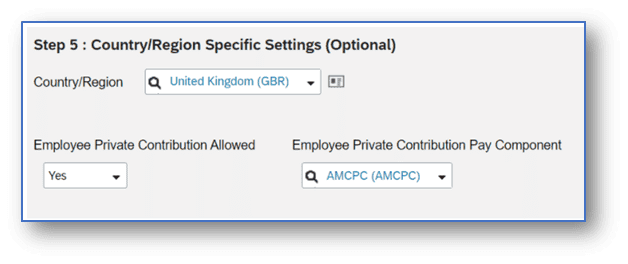

UK Insurances Feature for Employee Contribution to Private Medical: Ref. #: BEN-9958

Holding true to the innovation commitment, the ECGB platform is seeing improvements in the United Kingdom to the Insurances in H1. Insurance plans in the UK will now be configurable to track employee private contributions for medical insurances offered by their employers. This is a win for employers and employees in the UK as employees can lower their tax liability by contributing to the cost of the medical on their own.

How to turn it on: Admin Opt-in

EXAMPLE: